Credit Strong

Credit Strong - Giving Your Finances a Boost

Many people find themselves in a spot where their credit standing could use a lift, or perhaps they want to put aside some money for the future. It's a common situation, and finding the right tools to help can sometimes feel a bit like looking for a specific star in the night sky. Credit Strong comes into the picture as one of those tools, offering different ways to help you build a better credit story and, in some respects, even grow your personal savings.

This service provides several options aimed at helping you improve your credit numbers. They offer various things, and while some of them might cost a bit more than other choices out there, they also come with a promise to help you make progress. It's all about finding something that fits what you need, really.

This piece will go through what Credit Strong offers, how their plans generally work, what they might cost you, and some other things you might want to think about. We'll look at the good points, the things to consider, and how they share your payment activities with the big credit reporting groups, so you know just what to expect, as a matter of fact.

- Kristen Stewart Girlfriends

- Is Maria Genero Married

- Matt Mcgorry Relationship

- Bernadette Robi Age

- Tyler The Creator Ex

Table of Contents

- What is Credit Strong, really?

- How does a Credit Strong account work?

- What kinds of Credit Strong products are there?

- What about the costs and how Credit Strong reports your progress?

- Are there any hidden fees with Credit Strong?

- What do people say about Credit Strong?

- What kind of results can you expect with Credit Strong?

- Getting help with your Credit Strong account

What is Credit Strong, really?

Credit Strong is, in a way, a service that brings together a couple of different financial concepts to help people get their credit standing in better shape. It's a mix of a secured loan that you pay back over time and a savings account that has government protection for your money. This combination means that as you make your regular payments, you're not just working on your credit story, but you're also putting some money aside for yourself. It’s a pretty neat idea, honestly.

The main idea behind Credit Strong is to give your credit numbers a push upwards. They have a good track record, it seems, of doing just that. Credit Strong is actually part of Austin Capital Bank, which is a financial place in Austin, Texas, that has earned a top rating. So, you're dealing with a recognized institution, which is good to know, you know?

How does a Credit Strong account work?

When you get a Credit Strong account, it’s a bit like taking out a loan, but with a twist. You don't get the money right away to spend. Instead, the money is held in a special savings account that's set up for you. As you make your regular payments on the loan part, Credit Strong tells the big credit reporting groups about your good payment habits. This helps to build up your credit story over time. Meanwhile, the money you're "saving" in that special account grows, and you get it back once you've finished paying off the loan. It's a fairly simple process, basically.

One thing to keep in mind is that, like with most money places, there are rules to follow. The government has put in place some requirements to help stop things like funding bad activities, or people trying to steal someone's identity. So, when you open an account with Credit Strong, they will need to get some details from you, check that they are correct, and keep a record of who you are. This is just a standard step to keep everyone safe, you know, and is something that every financial institution must do.

What kinds of Credit Strong products are there?

Credit Strong has a few different ways they try to help people build their credit. They offer what they call an installment loan and a savings account setup. The installment loan is set up to give you the feeling of borrowing money and then paying it back over a set period, much like you would with a regular loan. This helps you get used to that kind of financial commitment and shows you can handle it. They have several specific options, too, for different needs.

One of their offerings is called the Magnum plan. This is a kind of loan that's made for the only reason of really giving your credit numbers a strong push. It comes with a small amount you need to pay each month, which can make it easier to manage. Then there's the Freekick option, which is made just for younger folks, specifically teens. It's a good method for teens to get to know how to handle credit and set up a solid base for their credit standing early on, which is actually a smart move.

Beyond those, Credit Strong also provides options for businesses. Yes, they have a business credit builder loan, which is meant to help companies improve their credit numbers. This means if you're a business owner looking to get your company's financial reputation in better shape, they have something for you too. It seems they try to cover a pretty wide range of situations, which is quite useful.

What about the costs and how Credit Strong reports your progress?

When you're thinking about any service that helps with your money, what it costs is always a big question. Credit Strong does have charges for some of its options. For instance, the Instal accounts have a $15.00 charge each month. If you go for the CS Max account, that one asks for $25.00 a month. While these amounts are what you'll pay each month for those specific accounts, they do say there are no other money asked for with Credit Strong. So, what you see for these plans is generally what you get, which is good to know.

The least expensive way to begin with Credit Strong, if you're looking to keep your initial outgo low, is to pick the Instal account. It's their most basic offering in terms of cost. It's important to remember that while you're paying these monthly charges, the service is working to let the big credit reporting groups know about your payments. This regular reporting is a key part of how it helps to build your credit story, so that's something to keep in mind, you know.

Are there any hidden fees with Credit Strong?

Based on the information, Credit Strong states that once you've taken care of the monthly charge for either the Instal or CS Max account, there are no other money asked for. This means you shouldn't run into unexpected charges or extra costs beyond those regular monthly amounts. It's pretty straightforward in that sense, which is what most people prefer when dealing with their finances. They try to keep things clear, apparently.

What do people say about Credit Strong?

It's always a good idea to see what others think about a service before you commit. Credit Strong, being part of Austin Capital Bank, has a B grade from the Better Business Bureau. This rating gives you some idea of how they handle customer issues and their business practices. It's not the highest grade, but it's not the lowest either, so it's something to think about, really.

You might come across many not-so-good comments about Credit Strong. However, it seems that these comments are often about the personal credit help option, rather than the business side or other specific plans. This suggests that while some people have had issues, it might be tied to a particular part of their service. It's always helpful to read these comments with a bit of thought, trying to understand the full picture, you know, and what they're actually about.

What kind of results can you expect with Credit Strong?

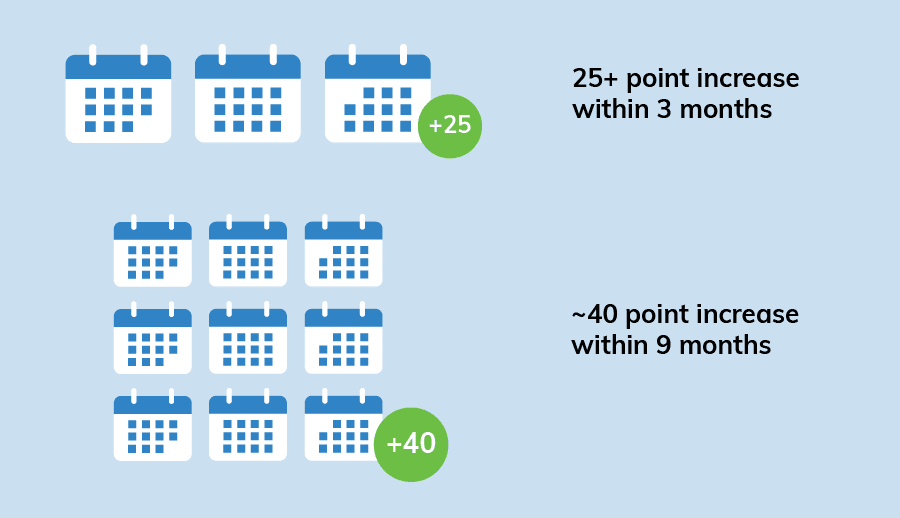

Credit Strong has looked at many of their customer accounts to see how well their service works. They say they looked at 50,000 of these accounts and noticed that people's FICO 8 numbers usually saw some good changes. They found that the usual person with an account saw their FICO 8 number go up by more than 25 points within just three months of starting their Credit Strong credit builder account. That's a pretty quick shift, in a way.

And it doesn't stop there. After nine months, the usual person's credit number improvement went up to nearly 40 points. This suggests that the longer you stick with the program, the more positive impact it might have on your credit standing. They collected facts on over 50,000 of their customer accounts and watched what happened with those numbers, which gives you a sense of the scale of their findings. So, you could reasonably expect to see some movement in your credit score if you keep up with the plan, too.

Getting help with your Credit Strong account

If you ever need support with your Credit Strong account, they do have ways to help. This includes things like sorting out problems with paying your monthly amount, getting your account ready when you first start, and answering things people often ask. It’s always good to know that there's a place to turn if you run into any questions or need a hand with something. They aim to make sure you can find the answers you need without too much trouble, so.

In short, Credit Strong offers different ways to help people build their credit numbers and put aside some money for the future. They have various options, like the Instal and CS Max accounts, and even a special one for teens called Freekick, plus a loan for businesses. While there are monthly charges for these, they say there are no other money asked for. They report your payment activities to the big credit reporting groups, and their own findings suggest people see their credit numbers go up over time. They are part of Austin Capital Bank and have a B grade from the Better Business Bureau, with some not-so-good comments often about the personal credit help option. They also have support if you need a hand with your account or have questions.

- Alison Doody Husband

- Paige Vanzant Relationships

- Finneas Girlfriend

- Zendaya Dating History

- Jimena G%C3%B3mez Paratcha Age

What Is a Credit Builder Loan, and Does It Work? - Credit Strong

Credit Strong Review for 2023: Is Credit Strong Worth It?

10 Best Credit Building Apps in 2024: Personally Ranked & Reviewed